Need for Surveillance

Securities markets are essential for the growth and development of an economy as it offers individuals and large, small and medium-scale enterprises a broader menu of financial services and tailored financial instruments. Further, the forces of globalization, technology, changing investor demographics, and new forms of competition have dramatically transformed securities markets worldwide.

Since emerging middle class/retail investors are placing an increasing proportion of their money in securities markets and in-turn creating growing demand for property ownership, small-scale investment, and savings for retirement, securities markets have become central to individual wealth and retirement planning. This requires a sound and effective regulation which builds confidence of investors in the market as openness, fairness and sound regulation are cornerstone requirements to ensure efficiency and the fairest of practices in the integration of the securities markets.

On the other hand, in the wake of globalization and technological advancements, those have increased the cross-border activities and flow of money; organizations like World Federation of Exchanges (WFE) and International Organization of Securities Commissions (IOSCO) are stepping up their efforts to promote the immediate needs for real-time market surveillance, risk management and regulation of cross-border trading in order to harmonize the global activities at exchanges and maintain the integrity of the securities markets.

Market Surveillance System

Effective surveillance is the sine qua non for a well functioning capital market. As an integral part in the regulatory process, effective surveillance can achieve investor protection, market integrity and capital market development. According to IOSCO (International Organization of Securities Commissions), “the goal of surveillance is to spot adverse situations in the markets and to pursue appropriate preventive actions to avoid disruption to the markets.”

So, the question arises, what is a market surveillance system and how does it work?

And the answer can be summarized as:

As with most trading platforms, surveillance systems within exchanges around the world are automated. Real time computer surveillance systems alert surveillance staff of unusual trading activity based on orders and executed trades. Such alerts are not usually based on single trades but are generated based on patterns of trading to detect potential manipulative practices.

Different types of market manipulations can be the subject of both single and cross-market surveillance. Single-market manipulations can also be a cross-market manipulation (such as for a security that is listed on more than 1 exchange) or cross-product manipulations (such as a derivative and its associated stock). For example, wash trades may take place across markets (in fact, multiple transactions across markets could be used as a way to disguise wash trades). Front-running may also take place across markets where brokers place orders ahead of client orders for the same security traded on a different exchange.

Indian Experience

In India, the stock exchanges hitherto have been entrusted with the primary responsibility of undertaking market surveillance. Given the size, complexities and level of technical sophistication of the markets, the tasks of information gathering, collation and analysis of data/information are divided among the exchanges, depositories and SEBI.

Information relating to price and volume movements in the market, broker positions, risk management, settlement process and compliance pertaining to listing agreement are monitored by the exchanges on a real time basis as part of their self-regulatory function.

In addition to the measures taken by stock exchanges, the regulatory oversight, exercised by SEBI, extends over the stock exchanges through reporting and inspections. In exceptional circumstances, SEBI initiates special investigations on the basis of reports received from the stock exchanges or specific complaints received from stakeholders as regards market manipulation and insider trading.

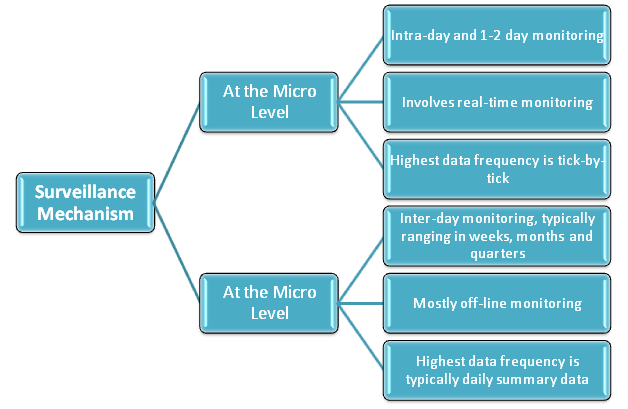

Surveillance system provides facilities to comprehensively monitor the trading activity and analyze the trade data online and offline. To better understand the functioning of the system let’s consider the surveillance mechanism put in place by NSE:

On-Line Exposure Monitoring

Exchange has put in place an on-line monitoring and surveillance system whereby exposure of the members is monitored on a real time basis. A system of alerts has been built in so that both the member and the NSCCL are alerted as per pre-set levels (reaching 70%, 85%, 90%, 95% and 100%) when the members approach their allowable limits. The system enables NSSCL to further check the micro-details of members' positions, if required and take pro-active action.

The on-line surveillance mechanism also generates various alerts/reports on any price/volume movement of securities not in line with past trends/patterns. For this purpose the exchange maintains various databases to generate alerts. Alerts are scrutinized and if necessary taken up for follow up action. Open positions of securities are also analyzed. Besides this, rumors in the print media are tracked and where they are price sensitive, companies are contacted for verification. Replies received are informed to the members and the public.

Off-line Monitoring

Off-line surveillance activity consists of inspections and investigations. As per regulatory requirement, a minimum of 20% of the active trading members are to be inspected every year to verify the level of compliance with various rules, byelaws and regulations of the Exchange. The inspection verifies if investor interests are being compromised in the conduct of business by the members.

The investigation is based on various alerts, which require further analysis. If further analysis reveals any suspicion of irregular activity which deviates from the past trends/patterns and/or concentration of trading at exchange at the member level, then a more detailed investigation is undertaken. If the detailed investigation establishes any irregular activity, then disciplinary action is initiated against the member. If the investigation suggests suspicions of possible irregular activity across exchanges and/or possible involvement of clients, then the same is informed to the market regulator, SEBI.