Tumbling oil prices is the biggest energy story in the world right now as global oil prices are in free fall over the past seven months. In the mid of 2014 oil prices were around $115 per barrel but since than the prices have fallen below $50 per barrel for the first time since May 2009. Steep fall in oil prices leads to significant revenue shortfalls in many energy-exporting nations, while many importing countries are likely to pay less for their requirements.

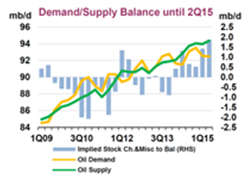

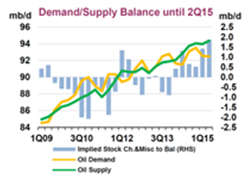

By the second half of 2014, world oil supply was on track to rise much higher than actual demand and, in September, prices started falling sharply. The oil price is partly determined by actual supply and demand, and partly by expectations of the market participants. Demand for energy is closely related to economic activity. It also spikes in the winter in the northern hemisphere, and during summers in countries that use energy to cool the internal temperature with air conditioning. Supply can be affected by weather (which prevents tankers loading) and by geopolitical upsets. If producers think the price is staying high, they invest more on technology and exploration, which after a lag boosts supply. Similarly, low prices lead to an investment drought. As per the International Energy Agency (IEA) Oil Market Report for November 2014, the production of oil in November stood at 94.1 mbpd and demand estimates stood at 92.4 mbpd.

By the second half of 2014, world oil supply was on track to rise much higher than actual demand and, in September, prices started falling sharply. The oil price is partly determined by actual supply and demand, and partly by expectations of the market participants. Demand for energy is closely related to economic activity. It also spikes in the winter in the northern hemisphere, and during summers in countries that use energy to cool the internal temperature with air conditioning. Supply can be affected by weather (which prevents tankers loading) and by geopolitical upsets. If producers think the price is staying high, they invest more on technology and exploration, which after a lag boosts supply. Similarly, low prices lead to an investment drought. As per the International Energy Agency (IEA) Oil Market Report for November 2014, the production of oil in November stood at 94.1 mbpd and demand estimates stood at 92.4 mbpd.

Reasons behind the oil price nosedive

To understand this story, we first have to go back to the late 2000s. World oil prices experienced a sustained upward movement. By far the most important reason for this long-term trend is the rising demand for these products stemming from rapid economic growth in China and other emerging-market economies including India. That led to large price spikes, and oil hovered around $100 per barrel between 2011 and 2014. This robust growth in oil demand encouraged companies in US to step up for exploration, developing higher cost sources, and making some major technological breakthroughs to start drilling for new, hard-to-extract crude in shale formations in North Dakota and oil sands in Alberta. This slowly led to a glut in oil production. Here are some main reasons of big drop in oil prices.

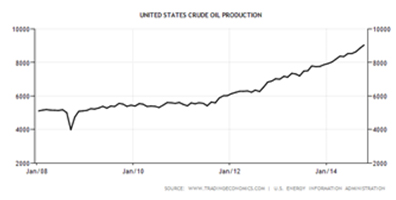

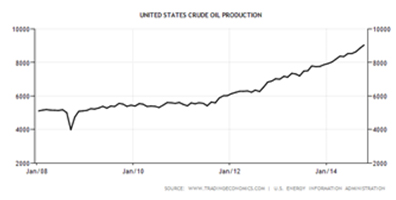

US Shale oil production

America’s oil boom is well documented. Shale oil production has grown by roughly 9 million barrels per day (mbpd), that is just 1m b/d short of Saudi Arabia’s output. Imports from OPEC have been cut in half and for the first time in 30 years, the U.S. has stopped importing crude from Nigeria. Bursting US oil production has transformed one of the world’s leading oil consumers into one of its leading producers. Innovative drilling that has unlocked oil and natural gas deposits trapped in shale rock. Their manic drilling—they have completed perhaps 20,000 new wells since 2010, more than ten times Saudi Arabia’s tally which boosted US oil production by a third after Russia & Saudi. The International Energy Agency has predicted that U.S. oil output will overtake Saudi Arabia’s by 2020.

Price war

The pace of the slide accelerated in November when the Organization of Petroleum Exporting Countries (OPEC) decided to maintain production at 30 million barrels per day on big meeting of their members in Vienna. Some members like, Venezuela and Iran, wanted the cartel (mainly Saudi Arabia) to cut back on production in order to prop up the price. These countries need high prices in order to “break even” on their budgets and pay for all the government spending they’ve racked up. But on the other hand Saudi Arabia opposed to cutting production and willing to let prices keep dropping because it don’t want to sacrifice its own market share to restore the price. Saudi Arabia has taken a lesson from what happened in the 1980s, when prices fell and the country tried to cut back on production to prop them up. The result was that prices kept declining anyway and Saudi Arabia simply lost market share.

OPEC’s refusal to cut production seemed like the boldest evidence yet that the oil price drop was really an oil price war between Saudi Arabia and the US. It is relatively cheap to pump oil out of places like Saudi Arabia and Kuwait. But it’s more expensive to extract oil from shale formations in places like Texas and North Dakota. Saudi Arabia can tolerate lower oil prices quite easily. It has over $700 billion in foreign currency reserves. Its own oil costs very little (around $5-6 per barrel) to get out of the ground. So as the price of oil keeps falling, some US producers may become unprofitable and go out of business. And the price of oil will stabilize. At least that’s what OPEC members hope.

Libya and Iraq are back

Till the mid 2014 oil prices are rising, the US Shale boom had little effect on oil prices because at the same time geopolitical conflicts were flaring up in key oil regions, There was a civil war in Libya and Syria, Russia’s annexation of the Crimea and broad advances by Sunni insurgents across northern Iraq. Turmoil in Iraq and Libya, two big oil producers with nearly 4m barrels a day combine, has not affected their output at a time when demand is low.

In July, Libyan rebels opened two key export terminals, Es Sider and Ras Lanuf, that had been shut down for a year. Libyan exports rose unexpectedly. Initially, it had been assumed that Libya’s output would hover around 150,000-250,000 thousand barrels per day but it turns out that Libya has sorted out their disruptions much quicker than anticipated, producing 810,000 barrels per day in September and expecting 1.2 million barrels a day by early this year.

European Economic Slowdown

Oil prices are falling because of changes in world supply and world demand. Demand has slowed because Europe is an economic wreck. European economies, meanwhile, are weak. Combined with the weak euro, which is near its all-time low, that means Europeans are less inclined to use energy. One of the reasons for an extension in the decline was the disappointing German output that reinforced worries that global oil demand will falter, it’s exports were down 5.8 percent in August, stoking the fears of anxious investors that the EU’s largest economy had double dipped into recession last quarter. Across the Eurozone, the IMF again lowered its growth forecast to 0.8 percent in 2014 and 1.3 percent in 2015. Austerity measures and decreased consumption across Europe are curbing oil demand.

Weak Asian Demand

The remarkable fall in global oil prices is continuing because of a mismatch in demand and supply. Demand is down because of Eurozone’s economic stagnation, Japan’s slipping into recession and China’s slowdown. Output, on the other hand, is rising on account of the U.S. shale boom. A global economic slowdown has left Asian demand weaker than expected and number of Asian countries have begun cutting energy subsidies, resulting in higher fuel costs despite a drop in global oil prices. In India between 2008-2012, diesel demand grew between 6 percent and 11 percent annually. In January 2013, the country started cutting the subsidies of diesel. Since then, diesel consumption has stablised. The US is producing record amounts of oil, and there’s plenty of supply out of OPEC and Russia. But there’s not enough demand from China and India, to consume all the oil that’s being supplied.

Impact of Oil Price Plummet: Winners & Losers

Oil prices affect almost everyone, for better or for worse. Petroleum products are a big slice of families’ budgets and a significant cost of production for a myriad of industries. It is no surprise that lower oil prices benefit consumers and hurt producers. For the users of oil, a lower price is like a tax cut. The positive effect will work its way through the economy via two channels: first, it will give consumers more disposable income, which they can spend on goods and services; second, it will reduce input costs and encourage production in sectors other than oil, especially energy-intensive sectors.

The dramatic drop in oil prices over the past few months to lowest since 2009 is leading to significant revenue shortfalls in many energy exporting nations. Meanwhile other economies that are large net importers of oil, such as China, Japan and Europe, will also get a boost to their economic growth.

The Losers:

The decline in oil prices has clear adverse effects, however, on oil-exporting emerging economies. Some of these countries, which have relied on high oil prices to balance their budgets, could face financial stress. Some examples are:

Russia

The Russian currency plunged against the dollar on the back of a decline in the price of crude oil, the country’s main revenue earner. Russia’s currency has lost some 16 percent against the dollar since the start of the year after dropping by around 41 percent in 2014. Russia is one of the world’s largest producers and its oil & gas exports accounts 70% of total export revenues. Russia’s central bank has been struggling to deal with this crisis. On December 15, the country suddenly hiked interest rates from 10.5 percent to 17 percent in an attempt to stop people from selling off rubles.

The economy is slowing sharply as Western sanctions over the Ukraine crisis deter foreign investment and spur capital flight, and as a slump in oil prices severely reduces Russia’s export revenues and pummels the ruble. The slump in oil prices has clouded Russia’s economic outlook, as the country relies heavily on revenues generated by exporting oil and gas to finance its budget. Russia loses about $2bn in revenues for every dollar fall in the oil price, and the World Bank has warned that Russia’s economy will shrink 2.9 percent in 2015 if oil prices do not recover. Russian Finance Minister Anton Siluanov said the budget faces a shortfall of up to $240 billion in revenue, most of it, about $180 billion is due to the oil-price collapse.

Venezuela

Venezuela is among the world’s largest oil exporters and is also tens of billions of dollars in debt, so their economy was struggling even before the oil prices dropped. Venezuela’s economy, which is heavily dependent on oil for 95 percent of its export revenue, has been crippled by the fall in oil prices and set to shrink some 3 percent this year and inflation is rampant.

The country already has some of the world’s cheapest petrol prices, fuel subsidies cost Caracas about $12.5bn a year, but President Maduro has ruled out subsidy cuts and higher petrol prices. The country’s needs an oil price of $118 per barrel to balance its external accounts, but oil is falling rapidly towards $40 per barrel and so far, Venezuela has failed to persuade other oil producers to reduce production in order to support the price. Venezuela’s foreign exchange outflows now substantially exceed its inflows, not least because it is supporting a complex and unhelpful exchange rate system: its US $ reserves are down to $22bn and falling fast.

The country already has some of the world’s cheapest petrol prices, fuel subsidies cost Caracas about $12.5bn a year, but President Maduro has ruled out subsidy cuts and higher petrol prices. The country’s needs an oil price of $118 per barrel to balance its external accounts, but oil is falling rapidly towards $40 per barrel and so far, Venezuela has failed to persuade other oil producers to reduce production in order to support the price. Venezuela’s foreign exchange outflows now substantially exceed its inflows, not least because it is supporting a complex and unhelpful exchange rate system: its US $ reserves are down to $22bn and falling fast.

Iran

Iran may be in the most trouble as it’s economy had recently started recovering after the geopolitical conflicts. IMF projected that the country will grow 2.3 percent next year, but now it is precarious situation to country after the oil price plummets. One big problem for Iran is that it also needs oil prices at $100 per barrel to balance its budget, especially since Western sanctions have made it much harder to export crude. If oil prices keep falling, the Iranian government may need to make up revenues elsewhere, it could by paring back domestic fuel subsidies. It spent 25% ($100 billion) of its GDP on consumer subsidies last year. As oil makes up about 80 %of total export earnings and 50 to 60% of government revenues, the economy could grow substantially under this scenario. With no deal, cheap oil could mean a 60% drop in fiscal revenues, down to $23.7 billion in 2015 from its peak of $120 billion in 2011/12. According to world bank report under this scenario, a loss of about 20% of GDP would be expected, bringing GDP growth down to zero (from the previous year’s 1.5%), and the economy would continue to shrink. This will put tremendous pressure on inflation, unemployment, the fiscal deficit and the currency.

Saudi Arabia

Saudi Arabia leads this pack and is now forecasting the biggest fiscal deficit in its history. The deficit for 2015 is expected to amount to $38.6 billion, announced by government. The Saudis can ride through this because they have a huge amount of foreign exchange reserves amounting to over $700 billion, which is why they remain steady in letting prices fall, mainly to ensure the production of U.S. shale oil does not increase and take some of their share of the market.

The Winners

Globally the big winner is the world economy. Tom Helblin of the IMF says that a 10% change in oil prices is associated with around 0.2% change in a global GDP. This essentially shifts the resources from the producers to consumers who are more likely to put that money back into the market.

Slumping oil prices could prove to be a boon for the many Asian economies that depend on crude imports as oil prices breaks the 5.6 years low. Falling oil prices should help lift emerging Asia’s gross-domestic-product growth this year to 4.7% from an estimated 4.3% in 2014.

China

China is the one of the largest net importers of oil, and fortunately most of its manufactured exports have not dropped in price, so its economy should benefit greatly from this plunge in oil prices. Oil prices have a big impact on the trade position of China, it has registered a record trade surplus for 2014 of $382bn, up by 47% from 2013, so nearly doubling its surplus from the previous year. Yet, trade growth has been weaker than targeted. China’s oil imports grew by nearly 10 percent last year, to nearly 2.3 billion barrels (308 million tons). As prices have fallen from around $115 a barrel in June to less than $50, importers are saving tens of billions of dollars.

Among the Asian economies, none is more dependent on oil imports than China. The country spent $234.4 billion to import oil in 2013. According to IEA December oil market report notes a sharp slowdown in Chinese oil demand growth, estimation of total Chinese demand growth is just 2.5 percent in 2014 and 2015. Despite recent falls in oil prices, Chinese government move in late November to hike consumption taxes for oil products has resulted in small price change to Chinese consumers, negating an expected economic benefit that would have come from lower prices.

Tumbling oil prices are still seen as a net benefit for the Chinese economy. Bank of America Merrill Lynch estimates China’s GDP increases by about 0.15 percent for every 10 percent drop in the oil price, with its current account balance growing by 0.2 percent of GDP and consumer inflation declining by 0.25 percentage point.

International Monetary Fund researchers have estimated that falling oil prices could boost China’s GDP by 0.4 to 0.7 percent 2015 and by 0.5 to 0.9 percent in 2016.

Japan

Japan imports almost all of its oil, Imported USD 150 bn in oil last year, so it should reap large benefits of cheaper prices. But the effects might also hurt the country’s economy. The higher energy prices have actually been pushing inflation higher and have been a part of the country’s economic growth strategy.

Japan has been suffering from a trade deficit, which stood at US $6.8bn in October, and was the highest on record last year at JPY11.5tn (US $120bn). An important driver has been the cost of oil and gas (34% of all imports), due to their shutting down all of their nuclear reactors Fukushima in 2011. Plummeting oil prices is a huge positive for them. The lower oil price will also be offset by the weaker yen, since the end of September, the yen has fallen by 8% against the dollar while crude oil prices have plunged by 60%.

The fall has became great challenge to the Bank of Japan due to the latest fall in inflation to 0.9%. The fall in the oil price will have a significant dis-inflationary impact, which is currently estimated at -0.4% on CPI.

India

India is one of the top oil importers, importing nearly 75% of its oil. Falling oil prices will will reduced India’s import bill, oil accounts for 37 per cent of its total imports. India, which is the fourth largest consumer of oil, is a big beneficiary of falling oil prices. The reduced prices will not only lower the import bill but also help save foreign exchange. As per Bank of America Merrill Lynch estimates, every $10 fall in crude could reduce the current account deficit by approximately 0.5% of GDP and the fiscal deficit by around 0.1% of GDP.

India had fuel subsidies of almost $22 billion for consumers, though much of that has gradually been cut, the cost of India’s fuel subsidies could fall by $2.5bn this year and the country is planning to deregulate fuel prices completely if oil continues its fall. The Indian government has increased the excise duty on petrol and diesel thrice since October 2014, in order to shore up its revenues.

Falling oil prices is not enough for Europe

Europe, meanwhile, is only partially benefiting from the decline in prices because the euro has been weakening, making it relatively more expensive for Europeans to purchase oil, which is priced in dollars. Falling oil prices has been welcomed by oil importing countries but European economy showed its mixed reaction on it. Lower oil prices will be welcomed by consumers who will see a rise in discretionary income, after years of a real wage squeeze this will help strengthen the economy. But the problem is that, looking at the wider economic situation it is hard to get too optimistic. The overwhelming impression is of a very weak European economy, which is struggling with a dangerous mix of austerity, deflation, weak growth and debt. Falling oil prices rather than helping increase spending is pushing down the headline inflation rate and making actual deflation a real possibility.

In the US

Most American consumers are delighted with the recent slide in the price of crude oil, which has lowered gasoline prices significantly,which have fallen to $2.47 per gallon, the lowest since 2009. Falling gas prices have an effect on consumer prices. The most recent CPI report was released on Jan.16 and consumer prices had fallen by 0.4% in Dec 2014. The core CPI, which excludes the volatile food and energy groups, rose by a mere 0.1%. The CPI rose 0.8 percent in 2014 after a 1.5 percent increase in 2013. This is the second-smallest December-December increase in the last 50 years, trailing only the 0.1 percent increase in 2008. It is considerably lower than the 2.1 percent average annual increase over the last ten years. The energy index, which rose slightly in both 2012 and 2013, declined sharply in 2014, falling 10.6 percent, the largest decline since 2008. According to Swiss investment bank UBS, US alone, boosts GDP by 0.1%, each $10-per-barrel drop in the price of oil. In US oil-producing states like Texas and North Dakota are likely to see a drop in revenues and economic activity. The falling price of oil is also putting severe pressure on Alaska’s state budget.

Crude Conspiracy: A Secret war on Russia and Iran

If we take it to other side, many believes that recent drop in the oil prices is the secret economic war on Russia and Iran by the US Saudi alliance. The US-Saudi oil price manipulation is aimed at destabilizing several strong opponents of US globalist policies. The alliance is trying to instill an economic collapse upon Moscow and Tehran, almost similar to what the US and Saudis did to the leaders of the Soviet Union in 1986. According to Article on WSJ , September meeting between US Secretary of State John Kerry and Saudi King Abdullah at his palace on the Red Sea arrived at a deal that the Saudis would support Syrian airstrikes against Islamic State (ISIS), in exchange for Washington backing the Saudis in toppling Assad.

Now, Saudi has used its oil weapon for proxy war against Iran to limit its nuclear energy expansion, and to make Russia change its position of support for the Assad Regime in Syria, Russia have provided the weapons and funding to keep Assad in power. While the US wants its Ukraine-related sanctions against Russia to have more bite. Sanctions imposed on Moscow over Ukraine and the low oil prices together will send the Russian economy into recession next year.

US Saudi alliance focusing to Squeeze them to the last drop and bankrupt them by bringing down the price of oil to levels below what is required for both Moscow and Tehran to finance their budgets with ease and control. Economy of both countries is highly reliable on revenue from oil exports, Iran need oil price to $140 to balance its budget favorable while Russia requires $100. The impact of lower prices strikes rouble badly as it already fallen over 14 percent since July against the US dollar, which puts Russian economy under more pressure as oil price quotes on US Dollar.

However, it is a conspiracy theory, use of oil weapon also hurts Saudi on its revenue in the longer term while in US, shale oil much expensive to extract surely it will hurts US producers as price are lower than the cost.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization of oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member Countries. OPEC seeks to ensure the stabilization of oil prices in international oil markets, with a view to eliminating harmful and unnecessary fluctuations, due regard being given at all times to the interests of oil-producing nations and to the necessity of securing a steady income for them. Equally important is OPEC’s role in overseeing an efficient, economic and regular supply of petroleum to consuming nations, and a fair return on capital to those investing in the petroleum industry.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization of oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member Countries. OPEC seeks to ensure the stabilization of oil prices in international oil markets, with a view to eliminating harmful and unnecessary fluctuations, due regard being given at all times to the interests of oil-producing nations and to the necessity of securing a steady income for them. Equally important is OPEC’s role in overseeing an efficient, economic and regular supply of petroleum to consuming nations, and a fair return on capital to those investing in the petroleum industry.